Peer Group Update FAQ

1. Why should I send in a peer group submission?2. Who should be submitting a peer group?

3. How do I submit my peer group?

4. I will not be disclosing a peer group in my upcoming proxy. Should I still send a submission?

5. My peer group hasn't and will not change. Should I still send a submission?

6. I have more than one peer group. Which one do I submit?

7. I cannot find one of my peers in the list of companies on the website. What should I do?

8. My peers will not be finalized by the time the peer group update period is over. Can I submit a peer update and have it adjusted afterward?

9. I have a question regarding Peer Group Update process and/or Equilar Market Peers.

1. Why should I send in a peer group update submission?

Submitting an updated peer group gives you the opportunity to inform Equilar of anticipated changes to your peer group. Equilar Market Peers will take into consideration either your most recently proxy-disclosed peers or an updated submitted peer group.

2. Who should be submitting a peer group?

For the mid-year update, submit an updated peer group if you plan to file a proxy between July 15 and January 14. For the year-end update, submit an updated peer group if you plan to file a proxy between January 15 and July 14.

3. How do I submit my peer group?

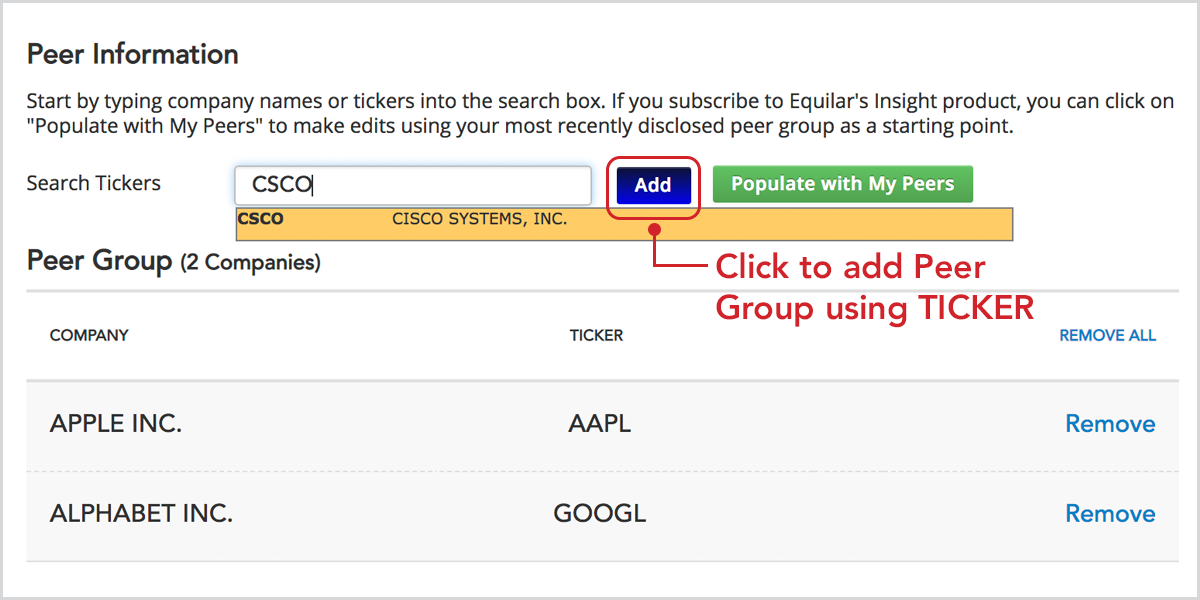

Submitting your peer group is easy. Access our Peer Group portal here. If you have an Insight login, you can use the "Populate With My Peers" button to automatically generate your current peers. If you don't have a login, you can still enter your peer group in using tickers.

4. I will not be disclosing a peer group in my upcoming proxy. Should I still send a submission?

Yes. Submit an update with only your own company as a peer and insert into the comments "No peers." Equilar will generally use the most recently proxy-disclosed peer group. Sending a submission will ensure that Equilar recognizes no peers for your company.

5. My peer group hasn't and will not change. Should I still send a submission?

Sending in a submission in this case will not have an impact on Equilar Market Peers.

6. I have more than one peer group. Which one do I submit?

Submit the peer group that you plan to include as your primary peer group in your upcoming proxy. If your proxy usually includes both backward-looking and forward-looking peer groups, submit a finalized forward-looking peer group.

7. I cannot find one of my peers in the list of companies on the website. What should I do?

If you cannot find a company in the submission search tool, insert the company name and ticker in the comments section. Note that private companies will not be considered in Equilar Market Peers.

8. My peers will not be finalized by the time the peer group update period is over. Can I submit a peer update and have it adjusted afterward?

Equilar Market Peers are updated twice a year. Your submission will be included in the next update.

9. I have a question regarding Peer Group Update process and/or Equilar Market Peers.

Contact your Equilar Account Manager directly or email peerupdate@equilar.com